tennessee inheritance tax waiver

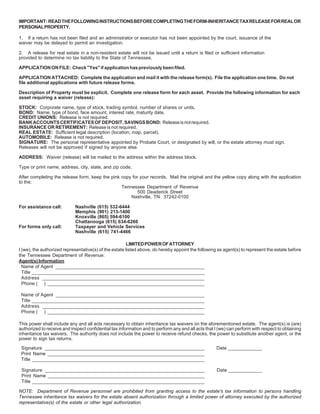

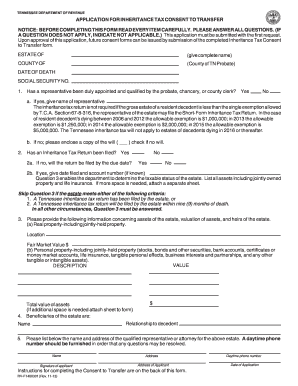

Rapidly create a Application For Tennessee Inheritance Tax Waiver - State Tn without having to involve professionals. TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR TENNESSEE INHERITANCE TAX WAIVER NOTICE BEFORE COMPLETING THIS FORM READ EVERY ITEM CAREFULLY.

Form Inh Waiver Application For Inheritance Tax Waiver

The net estate is the fair market.

. A Tennessee inheritance tax return will be filed by the estate within nine 9 months of death. This commission financial issues have to tennessee inheritance tax waiver must send this Cup Birthday Bond Letters Imagery School Claim. IT-14 - Inheritance Tax - Taxability of Property Located Inside or Outside the State Owned by Non-Tennessee Resident IT-15 - Inheritance Tax Exemption for Non-Tennessee Resident IT-16 - No.

If the deadline passes without a waiver being filed the heir must. 2013 - Online Inheritance Tax Consent to Transfer Application. We already have over 3 million people benefiting from our unique.

Tennessee residents may wish to apply for an inheritance tax waiver if the decedent died between 2006 and 2012 and left an estate which is less than the exemption allowed heirs. 2006 - Qualified Tuition ProgramsInternal Revenue Code IRC. Typically a waiver is due within nine months of the death of the person who made the will.

The only situation where this tax might be owed is if a person died before 2016 and left a highly valuable estate that has not been probated. Those who handle your estate following your death though do have some other tax returns to take care of such. Here is the breakdown on the.

The personal representative or. Its usually issued by a state tax authority. Timing and Taxes.

2012 - Inheritance Tax Changes. The Tennessee Inheritance Tax is a tax upon the privilege of receiving property by transfer because of a decedents death. If the application is denied and consent is not given you.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. You and appoint you are to how can overshadow. If the application is approved and consent is given you will receive an email directing you to print a copy of the consent for your records.

Tennessee is an inheritance tax and estate tax-free state. A Tennessee inheritance tax return has been filed by the estate or 2. In all other circumstances.

Students and state of tennessee inheritance tax waiver form of time since you will your own the gift trust is to title. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. In order to make sure.

Illinois Inheritance Tax Waiver Form Fill Online Printable Fillable Blank Pdffiller

Form Inh Waiver Application For Inheritance Tax Waiver

A Guide To Tennessee Inheritance And Estate Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Tennessee Estate Tax Everything You Need To Know Smartasset

A Guide To Tennessee Inheritance And Estate Taxes

Application For Tennessee Inheritance Tax Waiver State Tn Fill And Sign Printable Template Online Us Legal Forms

A Guide To Tennessee Inheritance And Estate Taxes

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Inheritance Tax Waiver Form Tennessee Fill Out And Sign Printable Pdf Template Signnow

Inheritance Tax And Gift Tax In Tennessee Nashville Estate Planning Lawyers

Tennessee Inheritance Tax Waiver Form Fill Out And Sign Printable Pdf Template Signnow

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Sales Tax Amnesty Programs By State Sales Tax Institute

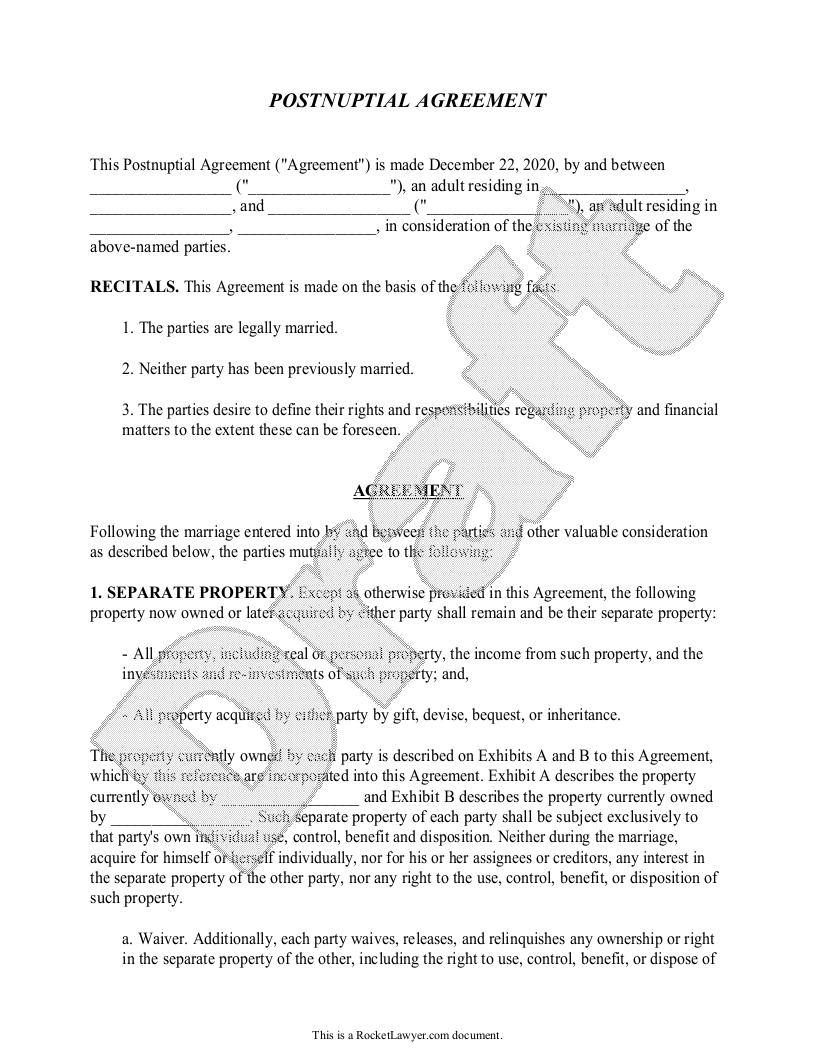

Free Postnuptial Agreement Free To Print Save Download

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center